FHA Single-Unit Approval (Spot Approval)

FHA with 3.5% Down Payment now allows single-unit condo approvals (also called spot approvals) — even if the condominium project is not on the FHA-approved list.

This change opens the door for more buyers to qualify for FHA financing on condos, creating new opportunities for closings.

What this means for your buyers:

- Access to FHA financing on more condo units

- Lower down payment options starting at 3.5%

- Expanded opportunities in communities not fully FHA-approved

As your loan partner, I can guide you and your clients through the spot approval process and work directly with HOAs to make transactions smooth and simple.

Here’s how it works:

Purpose: Allows a buyer to get an FHA loan in a condo project that is not fully FHA-approved.

Who can use it: Buyers purchasing one unit in a condo development.

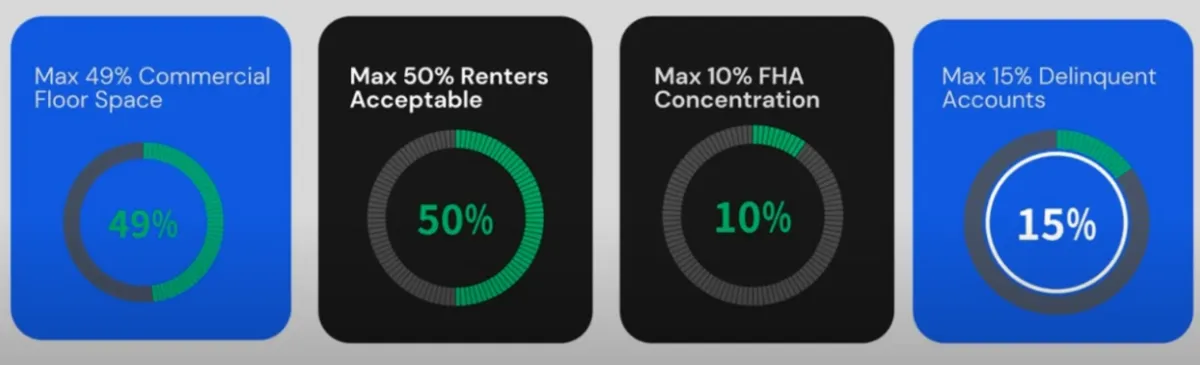

Restrictions: The condo project must have at least 5 units. No more than 10% of units (in projects with 10+ units) can be FHA-insured. For smaller projects (less than 10 units), only 2 units total can have FHA financing.

The full package is required, purchase contract, income docs, credit report, IDs, latest 2 months of Bank Statements.

HOA Documentation Needed: Budget, insurance certificate, and sometimes reserve study .HOA must confirm no litigation affecting safety, structural soundness, or habitability. Owner-occupancy must meet FHA’s guidelines (generally 50% or more).

Loan-to-Value (LTV): 96.5% LTV (which means at least 3.5% down) for a single-unit approval.

Seller Concessions: Up-to 6% for closing and pre-paids.

Submission Process:

The lender (not the buyer or HOA directly) submits the request for single-unit approval through HUD’s FHA Connection system.

The lender collects HOA docs (budget, insurance, questionnaire).

FHA reviews eligibility — usually takes 7-10 days turnaround.

Things to Watch Out For:

If the condo has major litigation, low reserves, or poor insurance coverage, FHA may deny approval.

FHA will also reject if there are too many investor-owned units or high delinquency rates in assessments.

In short: Yes, you can submit for a special/single-unit approval in Florida for FHA, but it must go through the lender handling the FHA loan.

Let’s connect so we can help more of your clients become homeowners!

Things to Watch Out For

See what You Qualify For

Work with an Expert Mortgage Consultant

22 Years Experienced as Loan Originator, 3 years as underwriting , 2 years as appraiser.

At Generation Mortgage Associates LLC , we partner with over 50 top lenders nationwide to find the best mortgage loan tailored to your specific needs. Regardless of your financial situation, credit history or income, we can secure a mortgage for you.

Our agents possess extensive expertise in the real estate market, staying ahead of trends and understanding property values. This enables them to offer you tailored, insightful guidance specific to your needs and goals.

Whether you prefer face-to-face meetings or virtual consultations, we are accessible and ready to assist. Trust us for a smooth and stress-free financing journey.

© Copyright 2026. All rights reserved by Generation Mortgage Associates LLC

Company NMLS#: 224585

1155 Pasadena Ave S - Suite H - South Pasadena, FL 33707

This website has not been reviewed, approved or issued by HUD, FHA or any governmental agency.