Purchasing or refinancing your home or property?

You could save thousands.

Step 1 - See what You Qualify For

W2 &

Tax Returns

2 years of W2s and Tax Returns

Jumbo,FHA ,Conventional,VA,USDA

Down payment as low as 3%

Score as low as 550 with 10% Down

Bank Deposits as Income

No W2s, No Taxes, No Paystubs!

Self-Employed we use the latest

12 Months of bank deposits.

Requires 20% Down

DSCR

For Rentals

No W2s, No Taxes, No Paystubs!

The rent must cover the mortgage,

Score as slow as 640

Min. 20% Down

FLIPS

Buy Fix Sell

No Income Required

Experience or No Experience

Score as slow as 640

10%-20% Down

Step 2 - Apply

BUY A HOME

REFINANCE

FHA-SPOT-APPROVALS

Condos with 3.5% DOWN !

An FHA spot approval allows individual units within a condominium project to be approved for FHA financing, even if the entire project is not FHA-approved.

Work with an Expert Mortgage Consultant

22 Years Experienced as Loan Originator, 3 years as underwriting , 2 years as appraiser.

At Generation Mortgage Associates LLC , we partner with over 50 top lenders nationwide to find the best mortgage loan tailored to your specific needs. Regardless of your financial situation, credit history or income, we can secure a mortgage for you.

Our agents possess extensive expertise in the real estate market, staying ahead of trends and understanding property values. This enables them to offer you tailored, insightful guidance specific to your needs and goals.

Whether you prefer face-to-face meetings or virtual consultations, we are accessible and ready to assist. Trust us for a smooth and stress-free financing journey.

JUMBO, Conventional, FHA, VA, USDA, ITIN, Bank Statements Income, P&L, VOE, Hard Money

HELOCS -Credit Lines – Reverse Mortgage – All types of loans! Bankruptcy, Foreclosure and Short Sale OK!

DSCR Loans: Investors can use the rental income a property will bring to qualify for the mortgage, instead of using traditional income calculations to purchase the property. A DSCR mortgage is a type of investment property loan.

Bank Statement Loans: For freelancers or contractors, a bank statement loan may be the best way to qualify for a self-employed mortgage. Instead of using tax documents and W2s, bank statements are used to calculate income.

Home Equity Loans: Homeowners who have built up equity in their home and need to access some of that money can do so with a Home Equity Loan. With a HELOAN, the interest rate in the initial loan remains unchanged.

USDA Loans: USDA loans are available for low-to-moderate-income individuals or families who are looking to purchase a home in a designated rural area.

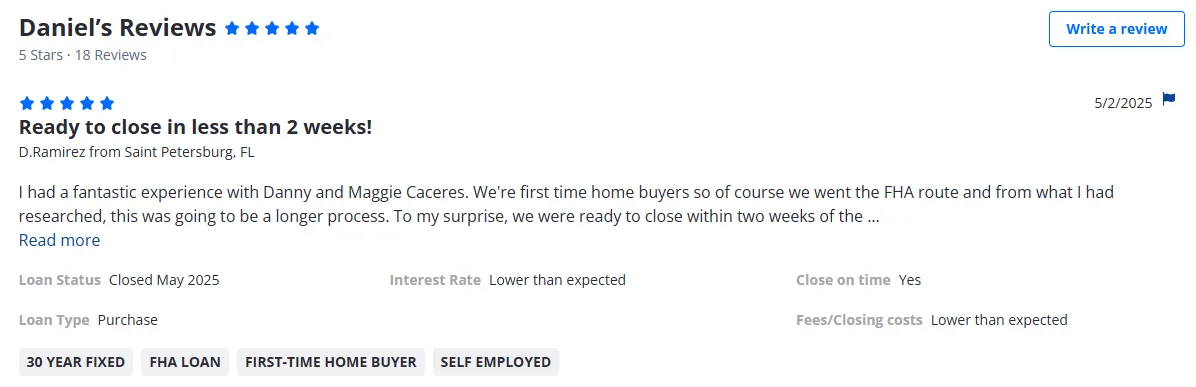

FHA Loans: FHA loans are available for first-time buyers and typically allow for a 3.5% down payment because these loans are insured by the Federal Housing Administration (FHA).

VA Loans: VA loans are offered as a benefit to veterans (or current service members) and their families. These loans require zero down because they are backed by the Department of Veteran Affairs (VA).

Asset Based Loans: For retirees, or high-net-worth individuals, an asset-based-loan is a way to enable borrowers to qualify for a mortgage based on the value of their wealth portfolio instead of traditional employment income.

ITIN Loans: Foreign nationals needing a mortgage to purchase a property can do so with a ITIN Loan, which does not require a Social Security number.

Conventional Loans: Conventional mortgages in Florida offer highly competitive rates and terms for qualifying borrowers. Secure a conventional home loan in Florida with as little as 3% down.

Private Money Loans: Funded by private lenders or investment groups, these loans, also known as hard money loans, are ideal for when you need quick access to short-term financing.

© Copyright 2026. All rights reserved by Generation Mortgage Associates LLC

Company NMLS#: 224585

1155 Pasadena Ave S - Suite H - South Pasadena, FL 33707

This website has not been reviewed, approved or issued by HUD, FHA or any governmental agency.